what is ea form malaysia

Do it in Feb so they can have their tax assessment in March. As of 2022 the deadline for filing Borang E in Malaysia is.

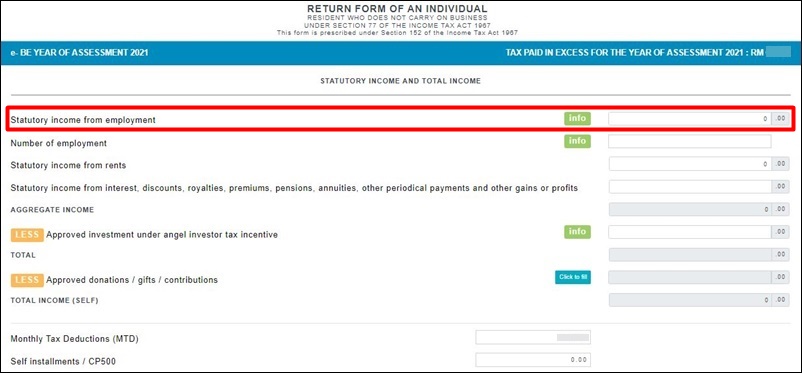

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing.

. EA form is for people that have Employment income. Updated over a week ago It is the obligation of employers in Malaysia to generate or prepare Form EA for employees e-Filing before March of every year. April 30 for electronic filing.

Form BE is your tax Submission to IRB. According to the Income Tax 1967 ITA 1967 Form EA. This employees statement of remuneration is also widely known as EA Form which shows the details of all employment income paid to each individual employee including the amount.

Once you register for E-Filing you will be given. What Is Form Ea Part 1 Defining The Benefits In Kind Pin On Quick Saves Malaysia Payroll Compliance How To Generate Ea Form In Deskera People. E-Filing starts from 1st.

Yearly Remuneration Statement for Private Employees. March 31 for manual submission. What if you fail to submit Form E.

When is the deadline and who should submit the form. Failure to comply to these regulations may lead to penalisation for your business. If you work for Public Bank then after every year end the company will give you an EA.

The EA form is a Yearly Remuneration Statement that includes your salary for the past year. Form E CP8D You may now send EA form to your colleagues by email or by print out the hardcopy. You will need to.

Lhdn Borang Ea Ea Form. For everyone who has no idea what EA forms are let us break it down for you. Use transaction SP01 to view the spool list.

EA Form meaning according to Inland Revenue Board Of Malaysia LHDN. In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A Form EA CP8C must be prepared and rendered to the employees on or. If you do E-Filing.

One of the biggest HR challenges in Malaysia is keeping up with the ever-changing HR regulations. The TP1 form is an income tax form that is given to an employer by an employee to make sure that all necessary rebates and deductions have been accounted for in the MTD monthly tax. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every.

Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following. Social Form EA Form EA is an annual income statement prepared by a company for employees tax submission purposes. Hence anyone can actually fake an EA Form.

EA or EC Form with customer layout EA Form and EA Summary report or EC Form and EC Summary report can be displayed on a customer defined. Once you have logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form. EA Form is given by Company.

What Is Form Ea Part 1 Defining The Benefits In Kind

Form St Partners Plt Chartered Accountants Malaysia Facebook

What Is Borang Cp38 Cp38 Form Cp 38 Deduction

Understanding Lhdn Form Ea Form E And Form Cp8d

Latest Ea Form In Malaysia Explanation And Resources Greatday Hr Blog

Malaysia Payroll Reports And Payslips For Easy Monthly Payroll

Solved A Wang Li From China First Arrived In Malaysia On 1 2020 And Commenced His Employment On 1 2020 With Easypay Sdn Bhd He Will Be A Charg Course Hero

What Is Ea Form Borang Ea Sql Accounting Software Hq

Form Ea Ktp Company Plt Audit Tax Accountancy In Johor Bahru

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Ea Form Malaysia Form Udlvirtual Edu Pe

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Understanding Lhdn Form Ea Form E And Form Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

Documentation Archives Actpay Payroll

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Troubleshooting Payroll Ea Form Does Not Show The Amount For Allowance Autocount Resource Center

Comments

Post a Comment